|

|

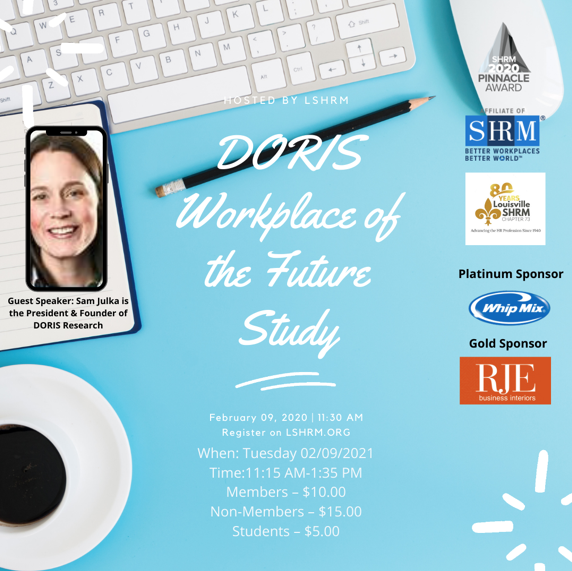

February Chapter Meeting: DORIS Workplace of the Future Study

SHRM and HRCI Certified

PROGRAM LEARNING OBJECTIVES

RJE commissioned DORIS to collect data in 5 research areas: collaboration, creativity, innovation, strategy, and productivity; focusing specifically on what each would look like in a post- COVID 19 world. They saw the need to adapt, innovate, and push the workplace forward to the future. The goal was to find answers to the questions, "Will we all move remote?" "What will offices look like moving forward?"; all the while, sparking creativity and innovation within each organization to imagine their future workplace; whether that be at home in, the office, or both!

SPEAKER INFO

Sam Julka is the President & Founder of DORIS Research. Sam started her career in Indianapolis as an Interior Designer at RJE Business Interiors, before returning to school in 2010 to earn her MFA in Design Thinking & Design Research from Indiana University’s Herron School of Art and Design. In 2012, Sam founded DORIS Research.

Since the founding of the company, Sam has worked with hundreds of organizations in many different industries across the country. In 2019 DORIS franchised and now operates as a franchise in three locations across the country. Sam is an alumnus of the forty first Stanley K Lacey (SKL) executive leadership class and was named a member of the IBJ’s Forty under 40 class in February of 2019. Sam lives in downtown Indianapolis with her husband, Chris, their three sons - Henry, Jasper, and Louie - and their dog, Porter.

|

|

|

|

|

|

|

|

|

LSHRM Legislative Update: February 2021

Kentucky Senate Bill 5

On January 6, 2021, the Kentucky Senate introduced Senate Bill 5, which, if adopted, would provide personal injury liability protections to certain Kentucky businesses. The bill specifically states that, if a business owner invites or permits another person to enter the premises “while a declared emergency affecting the premises remains in effect or continues,” the business does not “assume responsibility, or incur liability, for any alleged injury, loss, or damage to persons or property related to the conditions that are the subject of, or caused by, the declared emergency.” In other words, while Kentucky is still subject to a state of emergency regarding COVID-19, the new bill provides that businesses would be protected from liability if a patron caught or was exposed to COVID-19 while on the premises, subject to some limitations.

While Senate Bill 5 would not protect businesses or individuals who act in a malicious or grossly negligent manner, or those who willfully ignore Executive Orders or other COVID-19 guidelines, it seeks to provide businesses with some assurance that they will not be held responsible if they follow all applicable guidelines but, despite these best efforts, a patron is still exposed to COVID-19. Notably, the bill would apply retroactively to all activity since March 6, 2020. It also sets a one-year statute of limitations for filing a personal injury claim against any business or individual for injuries arising from the COVID-19 pandemic.

The bill, however, does not extend to claims filed against businesses by their employees. Employees would still be able to seek redress through the workers’ compensation system for work-related COVID-19 injuries. The bill has not yet progressed further than its initial introduction in the Senate, but as it makes its way through the legislative process, it is certainly possible that some of its provisions may be changed or eliminated entirely. Regardless of whether the bill ultimately passes in its current form, employers should continue to make good faith efforts to comply with all Executive Orders and associated COVID-19 guidelines.

|

|

|

Mark your calendars for Thursday, February 25th for our Career Advancement Program session: Networking / Volunteering with LSHRM to Advance Your HR Career!

Networking and volunteering are keys to success when it comes to creating your next job opportunity. One of my favorite quotes is “Your Network is Your Net Worth!” So if you have a goal of increasing your net worth in 2021, you definitely want to attend this session. Learn from our LSHRM President, Lisa Johnson, and LSHRM President-Elect, Laura Wood as they share how volunteering and networking through LSHRM has been instrumental to their careers. |

|

|

|

|

|

|

Louisville SHRM Certification Study Group Spring 2021

Registration for the Fall 2020 LSHRM Certification Study Group is now open!

If you or a colleague are currently preparing to sit for the SHRM Exam in the near future, our Certification Team invites you to join our 6-week study sessions, where we will provide additional resources and study tips to help you prepare.

|

|

|

|

|

|

|

Louisville Fight For Air Climb

Saturday, February 6

Lynn Family Stadium

Your Safety – Our Priority The safest environment for the 2021 ClimbLouisville is outside in the fresh air. We’re tackling the stairs at the Lynn Family Stadium with the following protocol:

- Spatial distancing and wearing masks

- Controlling flow and number of people on-site

- Following strict site sanitation protocols throughout the day

Why We Need You

The American Lung Association is directing a $25M initiative to end COVID-19 and defend against future pandemics while continuing our mission to fund research for lung health and support advocacy for clean air. Now, more than ever, your help is critical. |

|

|

|

|

Renew your LSHRM Membership Now

Don’t let your LSHRM membership lapse. Many of our members have renewal dates toward the beginning of the year and we want you to stay with LSHRM and help us continue to advance our HR Profession.

Don’t forget we are still meeting virtually every month and having great content for our meetings. Plus isn’t it just nice to see others when so many of us are still isolated? Meeting prices have been very minimal with active membership.

Your Membership includes:

-

Monthly Chapter Meetings

-

Networking - Opportunities available through many social events and chapter meetings

-

Volunteer opportunities

-

SHRM and HRCI recertification credits

-

Scholarship opportunities

-

Free job postings

-

SHRM discounted study materials and free study group

Joint LSHRM and SHRM Membership is only $50!

$80 for membership without national SHRM Membership.

Study Membership is only $15 (must register with edu email). |

|

|

U.S. Department of Labor Issues Final Rule on Independent Contractor Status

January 7, 2021

By Erin Shaughnessy and Bob Hoffer, DBL Law

On September 22, 2020, the United States Department of Labor (DOL) issued a proposed rule, offering guidance on independent contractor status under the Fair Labor Standards Act (FLSA). The proposed rule was published in the Federal Register on September 25, which began a 30-day comment period during which the public could provide comments or ask questions about the proposed rule. On January 6, 2021, the DOL announced the final rule on this issue. The final rule, 29 C.F.R. §§ 780, 788, 795, adopts an “economic reality” test to determine whether an individual is in business for him or herself, and thus an independent contractor, or is economically dependent on an employer for work, and thus an employee under the FLSA. This rule offers a more employer-friendly approach to the independent contractor determination under the FLSA. The rule will have implications under the FLSA which includes rules requiring minimum wage and overtime pay for covered employees and excludes independent contractors from certain recordkeeping requirements. The economic realities test focuses on two factors that are probative of independent contractor status: 1. The nature and degree of the individual’s control over the work – If an individual exercise substantial control over key aspects of the work performance, such as their schedule, selection of projects, and ability to work for others, that individual would likely be considered an independent contractor. If, however, the individual did not exercise such control, they would likely be considered an employee under the FLSA. 2. The individual’s opportunity for profit or loss – If an individual had the opportunity to earn profits and incur losses based on the exercise of his or her own initiative or management of his or her own investment on helpers or equipment to further their work, that individual would likely be considered an independent contractor. If, however, an individual did not possess these opportunities, they would likely be considered an employee under the FLSA. The DOL deems these factors highly probative of whether an individual is “an entrepreneurial independent contractor,” or a “wage earner employee.” Independent Contractor Status Under the Fair Labor Standards Act, 85 Fed. Reg. 60600, 60600 (proposed Sept. 25, 2020) (to be codified at 29 C.F.R. §§ 780, 788, 795. The new rule also identifies three factors that may serve as additional guideposts under the economic realities test including: (1) the amount of skill required for the work; (2) the degree of performance of the working relationship between the worker and the potential employer; and (3) whether the work is part of an integrated unit of production. The actual practice of the worker and the employer is more relevant to these factors then what may be contractually or theoretically possible. The final rule is set to be published in the Federal Register on January 7, 2021. This new rule comes just days before President-Elect Joseph Biden is set to take office, which raises questions about what action the President-Elect may take regarding the rule. The President Elect supports the Protecting the Right to Organize (PRO) Act which adopts the “ABC” Test, the more employee-friendly rule for classifying independent contractors that has already been adopted by states such as California. The newly published rule can be found here. |

|

|

SHRM Foundation Scholarships Available to Students and Young Professionals

LSHRM would like to alert you to the following scholarships that are currently available from the SHRM Foundation.

1) The SHRM Foundation is currently accepting applications for the "Professional Development Grant". This grant is designed to assist professionals pursuing their SHRM Certification (SHRM-CP or SHRM-SCP) during the Spring 2021 or Winter 2021 window.

To be eligible, individuals must be:

-

A current SHRM member (Professional or student membership must be active when applying and throughout the year in which you receive the award). Eligibility to sit for exam based on requirements for SHRM Certification. Testing in Spring 2021 or Winter 2021 Window. -

Exempt from receiving any organizational support or reimbursement for SHRM certification exam and preparation fees.

The deadline to apply is February 10, 2021. 2) The SHRM Foundation is currently accepting applications for Academic Scholarships - Graduate and Undergraduate.

To be eligible, individuals must be:

-

Current SHRM member (professional or student) Enrolled in a degree-seeking undergraduate program with at least one full semester remaining before graduation (see additional clarification below), OR accepted and ready to begin your studies within six months University is a regionally accredited institution of higher learning Degree program is HR-related (e.g. business, psychology, HR, org development, etc.) Minimum Grade Point Average -

-

Undergraduate - Cumulative GPA of at least 3.0 on a 4.0 scale

-

Graduate - Cumulative GPA of at least 3.5 on a 4.0 scale, or if not yet enrolled, an undergraduate GPA of 3.0 on a 4.0 scale

The deadline to apply is March 3, 2021. |

|

|

|

|

|

|

|

|

February is American Heart Month

5 Tips for a Healthier Heart

You already know that keeping your heart in tiptop shape means staying active and maintaining a nutritious diet. But oftentimes, it’s the little things that matter most. Here are a few small steps you can take that can make a big difference in helping you maintain a strong heart. |

|

|

|

|

Thank You To Our Sponsors and Partners!

Whip Mix Corporation, Platinum Sponsor

RJE Interiors, Gold Sponsor

Catholic Charities of Louisville, Non-profit Sponsor |

|

|

|